oregon workers benefit fund tax rate

OregongovdcbscostPagesindexaspx for current rate notice. Employers and employees split the cost evenly 11 cent per hour worked.

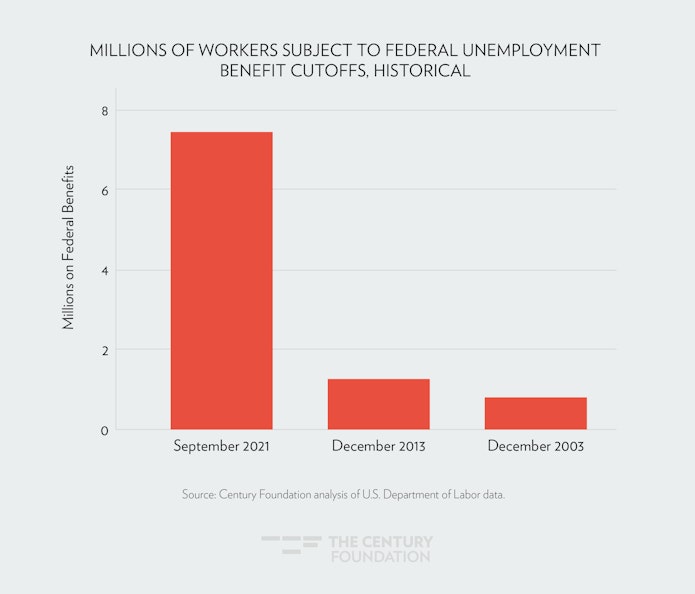

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

J Ragan over 8 years ago.

. Tax Formula Set Up. In 2021 this assessment is 22 cents per hour worked. If this box is blank please call 503-378-2372 for the current rate.

33 cents per hour. 28 cents per hour. Multiply box 9 times box 10.

165 cents per hour. Frances OEDs new modern system. The employee contribution is handled via tax code ORWCW and the employer contribution is handled via tax code ORWCW.

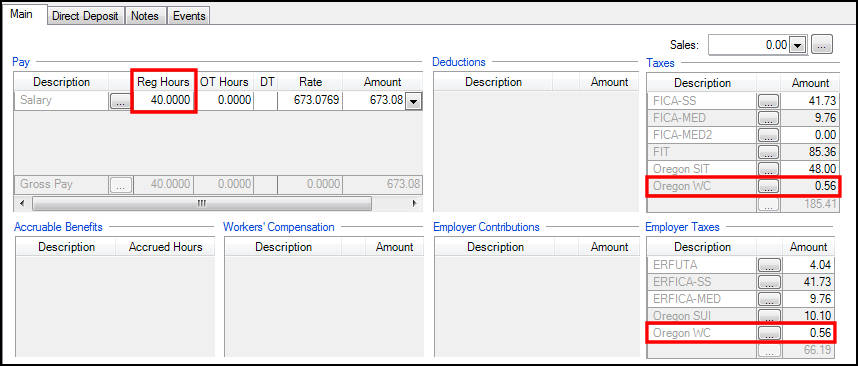

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to families of workers who die from workplace injuries or diseases. Employers contribute one-half of the hourly assessment amount and deduct one-half from workers wages. For my site employees in the state of OR I am unable to get the formula to deduct the WBF Workers Benefit Fund Tax.

UI Trust Fund fact sheet. This assessment will decrease to 22 cents per hour worked for 2020 down from 24 cents per hour for 2019. 165 cents per hour.

For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022. 165 cents per hour. Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year.

Workers Benefit Fund assessment. What is the 2022 tax rate. 28 cents per hour.

Lane Transit District LTD tax rate is 00077. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessmen t is 22 cents per hour worked in 2022 unchanged from 2021. Employers can deduct 11 cents per hour from employees if they choose to have employees pay a portion of the 22 cents per hour employer tax.

You are responsible for any necessary changes to this rate. Tax Formula Set Up. Go online at httpswww.

The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessmen t is 22 cents per hour worked in 2022 unchanged from 2021. If the Oregon Worker Benefit Fund OR WBF tax rate is changing in January any year.

Employers and employees split the cost. This booklet addresses only the WBF assessment and does not cover information provided in the annual Oregon Combined Payroll Tax Reporting Instructions located at httpswwworegongovdor. 14 cents per hour.

The rate is unchanged from 2021. Round down to the nearest cent. 22 cents per hour worked.

The 22 cents-per-hour rate is the employer and worker rate combined. WBF Assessment Rate Employers Portion Workers Portion. The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

The taxable wage base for Unemployment Insurance UI is 47700. Employers and employees split this assessment which employers collect through payroll. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years.

It is a tax based on the number of hours worked each check X 033. Line 10 of the formula can be set up one of two ways depending on how your company decides to handle the tax calculation for salaried Employees. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment.

Line 10 of the formula can be set up one of two ways depending on how your company decides to handle the tax calculation for salaried Employees. Oregon workers benefit fund tax rate Tuesday March 1 2022 Edit On July 1 2018 HB 2017 the Statewide Transit Tax STT went into effect which requires all employers to withhold report and remit one-tenth of one percent or 0001 of wages paid to employees. These benefits are funded by State Unemployment Tax Act SUTA payroll taxes paid by employers as well as reimbursements from governmental and non-profit employers.

Re-employment Assistance Program ORS 656622 The Re-employment Assistance Program provides employers incentives to rehire or hire injured workers. ResourceWorkers compensation rate information. The Oregon workers compensation payroll assessment rate is not to change in 2022 the state Department of Consumer and Business Services said Sept.

165 cents per hour. Statewide Transit tax STT rate is. General Oregon payroll tax rate information.

Employers and employees split the cost. Workers Benefit Fund Payroll assessment Special benefits for certain injured workers and their families and return- to-work programs. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee.

Employment is encouraged through premium exemption and providing funds for wage subsidies worksite modifications certain purchases and claim cost reimbursement for eligible employers and workers. 33 cents per hour. General Oregon payroll tax rate information.

Employers are required to pay at least 11 cents per hour. The workers benefit fund assessment rate is to be 22 cents per hour in 2022. Sage customer support gave me this.

Tri-County Metropolitan Transportation District TriMet tax rate is. The benefit fund assessment pays for return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to families of workers who die from workplace injuries or. Private-sector self-insured employer groups pay 103 percent Covers the costs of administering workers compensation and worker safety programs Workers Benefit Fund assessment No change remains at 22 cents per hour worked in 2022.

14 cents per hour. 10 2021 142 PM. This is the current worker and employer rate combined.

For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. 14 cents per hour. 1 2022 this assessment will see no change remaining at 22 cents per hour or partial hour worked by each person an employer must cover or chooses.

2021 Tax Rates and breakdown of changes for Oregon employers. You are responsible for any necessary changes to this rate. For Agency information please see Oregon Workers Compensation Division website.

Tax rates The Workers Benefit Fund WBF assessment rate. For example The 2017-2018 rate is 28 cents for each hour or partial hour and the 2019 rate is 24 cents The xxx cents includes the employer rate and worker rate combined. 14 cents per hour.

For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022. Employers contribute half of the hourly assessment and deduct half of the assessment from. 2021 UI Tax Relief fact.

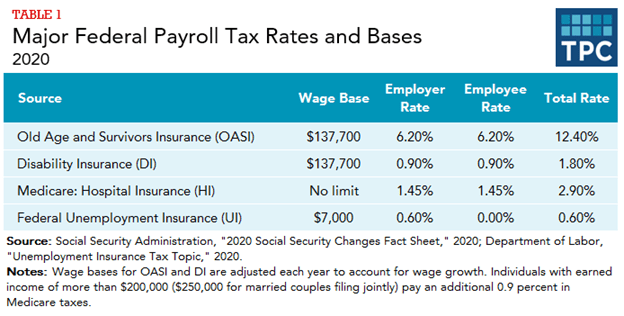

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

Neca Ibew Of Illinois Health And Welfare Plan Benefits Administration

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

Kingston Smith Llp Accountants Fraud Criminal Evidential Files Carroll Trust Auditors Case Trust Tax Trust Fund

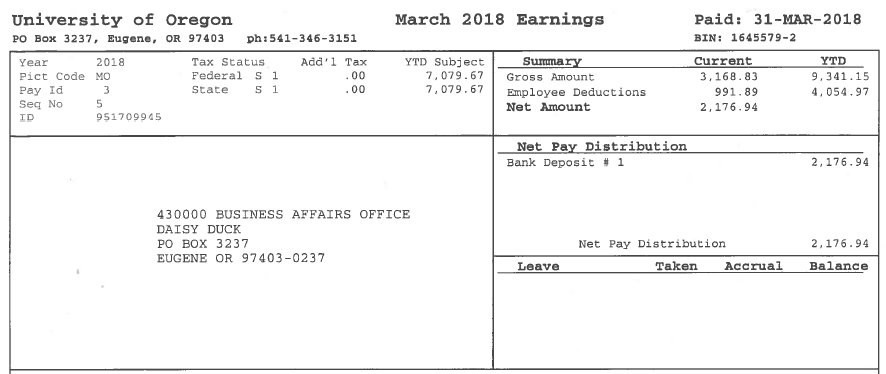

How To Read Your Earning Statement Business Affairs

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Pin On Legalshield Independent Associate

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

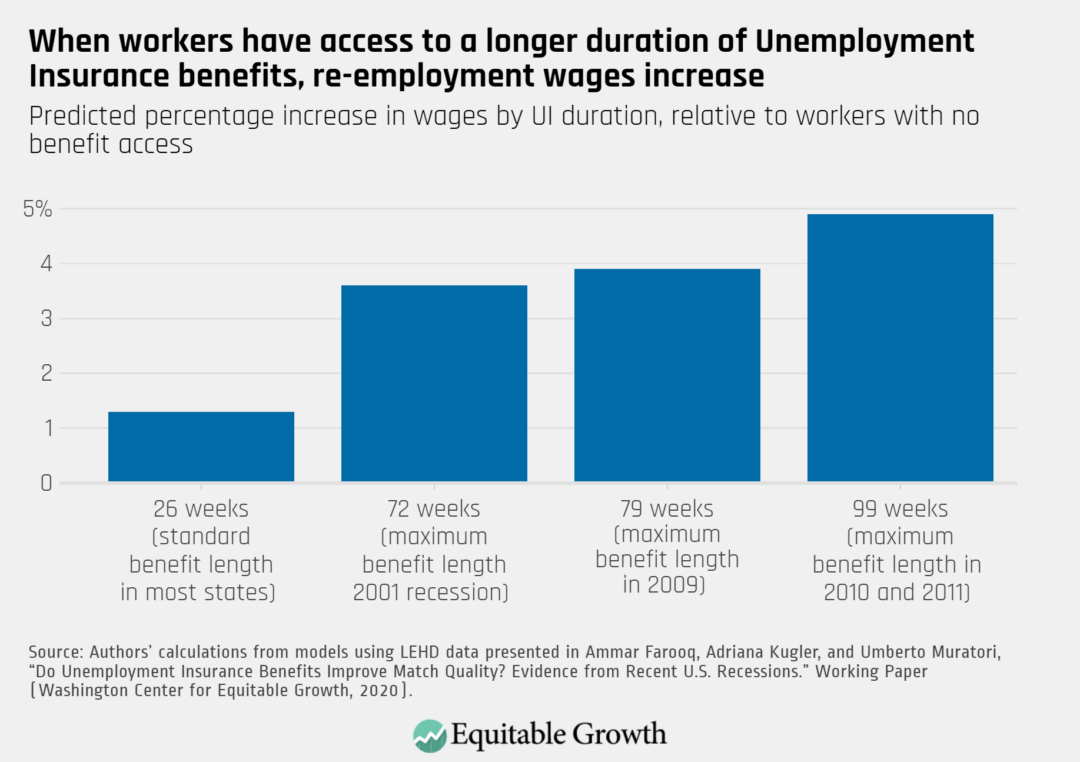

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Oregon Workers Benefit Fund Wbf Assessment

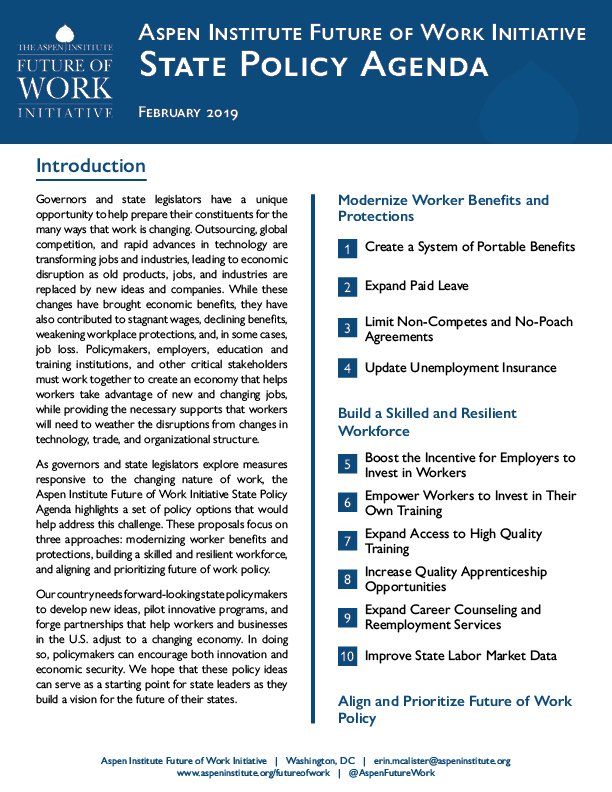

Future Of Work Initiative State Policy Agenda The Aspen Institute

How Much Is Workers Comp Insurance The Hartford

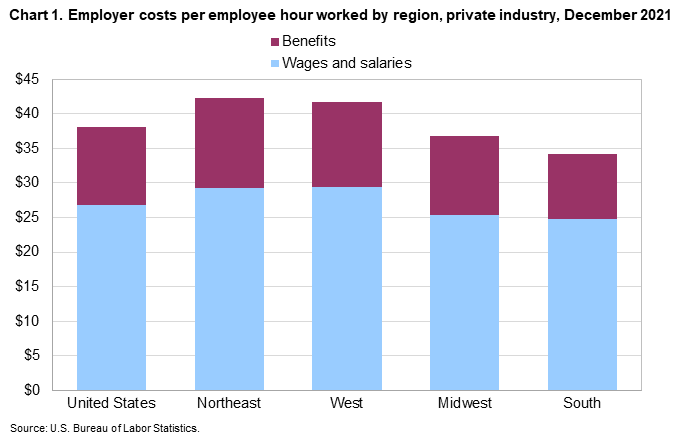

Employer Costs For Employee Compensation For The Regions December 2021 Southwest Information Office U S Bureau Of Labor Statistics

Centering Workers How To Modernize Unemployment Insurance Technology